GetTDDataInformation regarding prices and yields of bonds issued by the Brazilian government can be downloaded manually as excel files from the Tesouro Direto website. However, it is painful to aggregate all of this data into something useful as the several files don’t have an uniform format.

Package GetTDData makes the process of importing data

from Tesouro direto much easier. All that you need in order to download

the data is the name of the assets (LFT, LTN, NTN-C, NTN-B, NTN-B

Principal, NTN-F).

# from CRAN (stable version)

install.package('GetTDData')

# from github (development version)

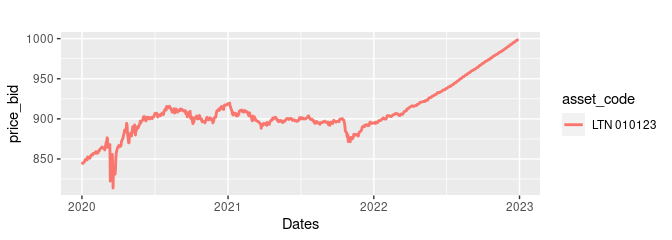

devtools::install_github('msperlin/GetTDData')Suppose you need financial data (prices and yields) for a bond of type LTN with a maturity (end of contract) at 2023-01-01. This bullet bond is the most basic debt contract the Brazilian government issues. It does not pay any value (coupon) during its lifetime and will pay 1000 R$ at maturity.

In order to get the data, all you need to do is to run the following code in R:

library(GetTDData)

assets <- 'LTN' # Identifier of assets

first_year <- 2020

last_year <- 2022

df_td <- td_get(assets,

first_year,

last_year)

#>

#> ── Downloading TD files

#> ℹ Downloading LTN_2020.xls

#> ✔ '/tmp/Rtmpf9eiRh/td-files/LTN/LTN_2020.xls' is found, with size 176.1 kB.

#> ℹ Downloading LTN_2021.xls

#> ✔ '/tmp/Rtmpf9eiRh/td-files/LTN/LTN_2021.xls' is found, with size 175.1 kB.

#> ℹ Downloading LTN_2022.xls

#> ✔ '/tmp/Rtmpf9eiRh/td-files/LTN/LTN_2022.xls' is found, with size 175.6 kB.

#>

#> ── Checking files

#> ✔ Found 3 files

#>

#> ── Reading files

#> ℹ Reading '/tmp/Rtmpf9eiRh/td-files/LTN/LTN_2020.xls'

#> ✔ Reading Sheet LTN 010121

#> ✔ Reading Sheet LTN 010122

#> ✔ Reading Sheet LTN 010123

#> ✔ Reading Sheet LTN 010125

#> ✔ Reading Sheet LTN 010126

#> ℹ Reading '/tmp/Rtmpf9eiRh/td-files/LTN/LTN_2021.xls'

#> ✔ Reading Sheet LTN 010122

#> ✔ Reading Sheet LTN 010123

#> ✔ Reading Sheet LTN 010724

#> ✔ Reading Sheet LTN 010125

#> ✔ Reading Sheet LTN 010126

#> ℹ Reading '/tmp/Rtmpf9eiRh/td-files/LTN/LTN_2022.xls'

#> ✔ Reading Sheet LTN 010123

#> ✔ Reading Sheet LTN 010724

#> ✔ Reading Sheet LTN 010125

#> ✔ Reading Sheet LTN 010126

#> ✔ Reading Sheet LTN 010129Let’s plot the prices to check if the code worked:

library(ggplot2)

library(dplyr)

#>

#> Attaching package: 'dplyr'

#> The following objects are masked from 'package:stats':

#>

#> filter, lag

#> The following objects are masked from 'package:base':

#>

#> intersect, setdiff, setequal, union

# filter LTN

my_asset_code <- "LTN 010123"

LTN <- df_td %>%

filter(asset_code == my_asset_code)

p <- ggplot(data = LTN,

aes(x = as.Date(ref_date),

y = price_bid,

color = asset_code)) +

geom_line(size = 1) + scale_x_date() + labs(title = '', x = 'Dates')

#> Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

#> ℹ Please use `linewidth` instead.

#> This warning is displayed once every 8 hours.

#> Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

#> generated.

print(p)

The latest version of GetTDData offers function

get.yield.curve to download the current Brazilian yield

curve directly from Anbima. The yield curve is a tool of financial

analysts that show, based on current prices of fixed income instruments,

how the market perceives the future real, nominal and inflation returns.

You can find more details regarding the use and definition of a yield

curve in [Investopedia][https://www.investopedia.com/terms/y/yieldcurve.asp].

library(GetTDData)

df.yield <- get.yield.curve()

str(df.yield)And we can plot it for the derised result:

library(ggplot2)

p <- ggplot(df.yield, aes(x=ref.date, y = value) ) +

geom_line(size=1) + geom_point() + facet_grid(~type, scales = 'free') +

labs(title = paste0('The current Brazilian Yield Curve '),

subtitle = paste0('Date: ', df.yield$current.date[1]))

print(p)